Tax rates on Investment in mutual fund schemes for Financial Year 2011-12.

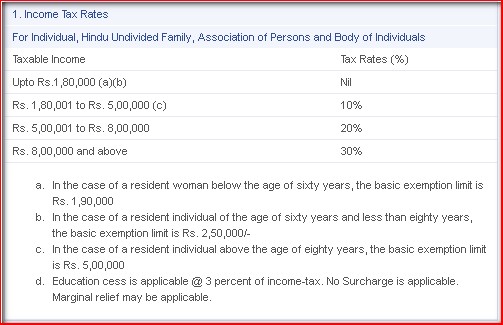

Applicable Income Tax Rates for 2011-12

|

| Add caption |

@ after providing for indexation

## Subject to NRI's having Permanent Account Number in India

*STT @ 0.25% will be deducted on equity funds at the time of redemption and switch to the other schemes.

Mutual Fund would also pay securities transaction tax wherever applicable on the securities bought/sold.

^Assuming the investor falls into the highest tax bracket

# The total income of the corporate would exceed Rs. 1 Crore

** The tax rates are subject to DTAA benefits available to NRI's

*** These are the tax rates applicable to capital gains, in case the rate of tax is lower than 20% and if the NRI does not have a Permanent

Account Number, then for the purpose of TDS, the withholding tax rate would be 20%.

## Subject to NRI's having Permanent Account Number in India

*STT @ 0.25% will be deducted on equity funds at the time of redemption and switch to the other schemes.

Mutual Fund would also pay securities transaction tax wherever applicable on the securities bought/sold.

^Assuming the investor falls into the highest tax bracket

# The total income of the corporate would exceed Rs. 1 Crore

** The tax rates are subject to DTAA benefits available to NRI's

*** These are the tax rates applicable to capital gains, in case the rate of tax is lower than 20% and if the NRI does not have a Permanent

Account Number, then for the purpose of TDS, the withholding tax rate would be 20%.

.....png)

.....png)

No comments:

Post a Comment